When two of the world’s biggest tech companies make a multi-billion-dollar deal, the ripple effects spread across the entire industry. Everyone takes notice, and that’s exactly what just happened: Meta has signed a six-year, $10 billion agreement with Google Cloud to support its rapidly growing artificial intelligence workloads.

The partnership took everyone by surprise. Meta has typically relied on Amazon Web Services (AWS) and Microsoft Azure for cloud services while also investing billions into its own data centers. But as the demand for AI infrastructure skyrockets, Meta has turned to a direct competitor in online advertising: Google.

This deal doesn’t just add revenue to Google’s balance sheet—it reshapes the dynamics of the cloud wars, validates Google’s role as an enterprise-ready cloud provider, and signals how artificial intelligence demand is forcing even the largest technology firms to rethink their alliances.

Table of Contents

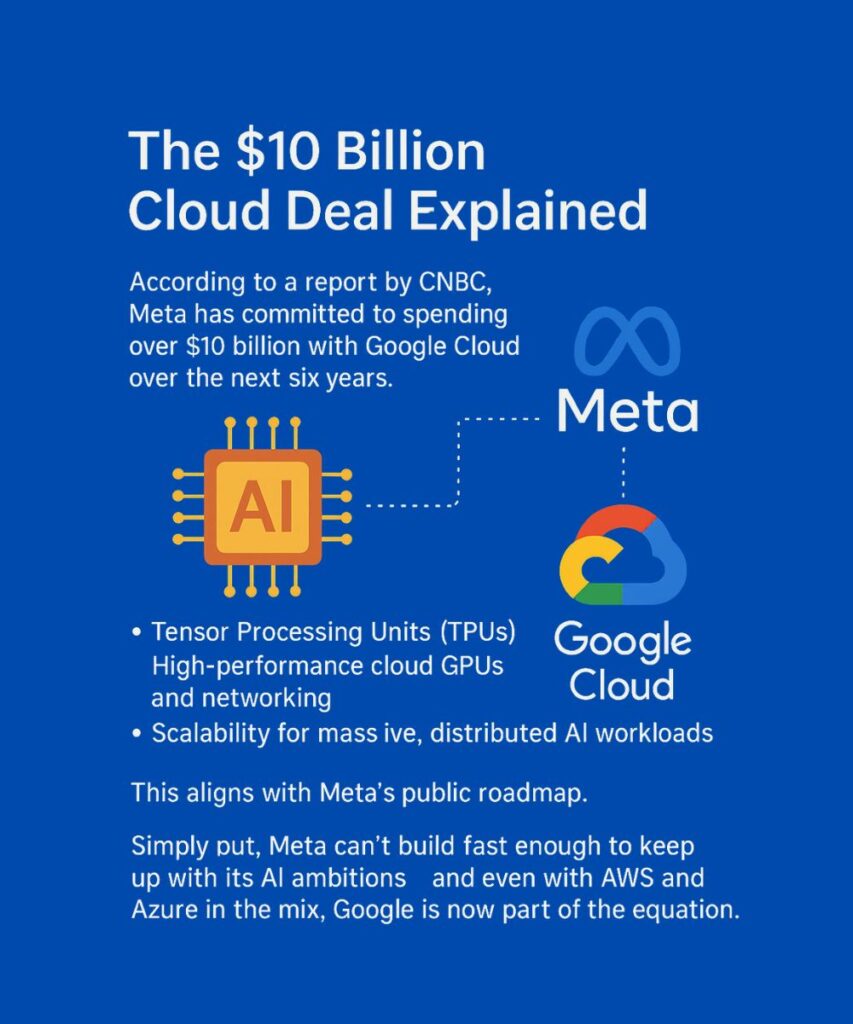

The $10 Billion Cloud Deal Explained

According to a report by CNBC , and backed up by The Information, Meta has committed to spending over $10 billion with Google Cloud over the next six years. While details are scarce due to confidentiality, sources indicate the deal is focused heavily on AI infrastructure.

That means that Meta isn’t just paying Google for their basic cloud storage or compute power. They are tapping into Google’s most advanced resources, including:

- Tensor Processing Units (TPUs), Google’s custom AI chips built for training large language models.

- High-performance cloud GPUs and networking infrastructure.

- Scalability for massive, distributed AI workloads.

This aligns with Meta’s public roadmap. In its most recent earnings report, Meta projected $114–$118 billion in expenses for 2025, with a significant portion earmarked for AI infrastructure and talent. Meta is all-in on building its LLaMA family of AI models and embedding AI across Facebook, Instagram, WhatsApp, and Threads.

Simply put, Meta can’t build fast enough to keep up with its AI ambitions—and even with AWS and Azure in the mix, Google is now part of the equation.

Why Meta Needs Google Cloud

On paper, Meta has one of the largest data center footprints in the world. Why then would it outsource so much compute power to a rival? Several reasons stand out:

AI Workload Scale

Training and running state-of-the-art AI models requires staggering amounts of compute. Even Meta’s world-class data centers are not enough. Cloud infrastructure provides the flexibility to burst workloads when demand spikes without waiting years to build new facilities.

Diversification of Cloud Providers

Meta is already working with AWS and Azure, but they realize relying too heavily on one partner is risky. Cost, availability, and bargaining power all matter at this scale. By adding Google into the fold, Meta ensures they have redundancy and leverage across all three hyperscalers.

Access to Google’s AI Chips

Google’s TPUs are highly regarded in the technology sector for their efficiency in AI training. By partnering with Google, Meta gains access to one-of-a-kind hardware that they simply can’t replicate in-house or source from AWS/Azure. This has the potential to speed up the training of future LLaMA models.

Faster Time-to-Market

Meta is racing not just against OpenAI and Anthropic but also against Google itself. Offloading infrastructure bottlenecks to Google Cloud allows Meta to bring AI-powered features to users faster.

In short, Meta is doubling down on its competition.

Why This Is a Big Win for Google Cloud

For Google, this is a landmark deal. Historically, Google Cloud has trailed AWS and Azure by a wide margin. But this win delivers multiple benefits:

Financial Impact

The deal adds roughly $1.6B per year to Google Cloud’s revenue stream. In Q2 2025, Google Cloud reported $13.6B in revenue and $2.83B in operating income. Meta’s contract alone represents more than 10% of Google Cloud’s quarterly revenue.

Enterprise Credibility

Winning Meta as a cloud client puts Google Cloud in rare company. AWS may be the default for many enterprises, and Azure is dominant in the Microsoft ecosystem, but this deal proves Google is no longer just the third option—it’s a strategic partner for AI leaders.

Momentum After OpenAI

Earlier this year, Google also secured workloads from OpenAI, a former Azure-exclusive. That’s two high-profile AI wins in less than a year. Together, they suggest Google is becoming the go-to provider for AI workloads, not just a catch-up player.

Validation of TPU Strategy

For years, Google has invested in its custom TPU chips. This deal validates that investment—showing not just internal use but external adoption at massive scale.

This isn’t just revenue; it’s a reputation shift for Google Cloud.

The Cloud Wars: AWS vs Azure vs Google Cloud

For over a decade, the cloud market has been dominated by AWS and Azure, with Google Cloud fighting for a distant third. Let’s see how this deal changes the battlefield.

AWS

- Still the market leader by revenue and customers.

- Provides Meta with significant infrastructure capacity.

- But hasn’t secured exclusivity, showing even AWS can’t monopolize AI deals.

Azure

- Strength lies in its deep integration with enterprise IT and Microsoft’s partnership with OpenAI.

- Azure is critical for organizations betting on ChatGPT and Copilot services.

- Losing exclusivity with OpenAI earlier this year raises questions about its hold on AI workloads.

Google Cloud

- Historically behind in adoption.

- Now carving out a specialty in AI-first cloud contracts.

- Winning both OpenAI and Meta in the same year signals a strategic breakthrough.

The message is clear: the cloud wars are entering a new phase, defined less by general workloads and more by AI-specific infrastructure.

The Frenemies Factor: Meta and Google

One of the most fascinating aspects of this deal is the irony of the partnership.

Meta and Google are bitter rivals in the digital advertising market. Both companies dominate global ad spend, and their competition has often been fierce. Yet here they are, working together on AI infrastructure.

This kind of “coopetition” is becoming more common in tech:

- Rivals compete fiercely in one area while collaborating in another.

- AI is so compute-intensive that it forces companies to set aside rivalries for access to resources.

For Meta, the risk is clear: it’s paying a direct competitor billions. But the benefits of speed, redundancy, and unique hardware outweigh the risks.

The Financial Picture: AI Spending Arms Race

This deal is part of a broader trend: AI is driving record levels of capital expenditure.

- Meta expects $114–118B in expenses for 2025, with AI infrastructure as a major component.

- Alphabet’s Google Cloud unit is growing 32% year-over-year, outpacing Alphabet’s overall 13.8% growth.

- AWS, Azure, and Google Cloud are all pouring billions into GPUs, TPUs, and specialized networking to meet demand.

In many ways, the AI boom is funding the next wave of cloud expansion. Just as SaaS adoption fueled early cloud growth in the 2010s, AI workloads are defining cloud growth in the 2020s.

What This Means for the Future of AI Infrastructure

The Meta–Google deal signals several future trends:

- Multi-Cloud Will Be the Norm

Companies won’t put all their eggs in one basket. AWS, Azure, and Google will often share workloads from the same enterprise. - Specialized Hardware Will Drive Cloud Choices

Whoever offers the best chips—whether Nvidia GPUs, Google TPUs, or custom silicon—will win AI contracts. - AI Will Reshape Cloud Market Share

While AWS and Azure remain dominant, Google’s focus on AI could accelerate its climb. Deals like Meta’s will force AWS and Azure to respond with their own AI-focused offerings. - “Frenemy” Partnerships Will Multiply

Expect to see more deals where rivals collaborate out of necessity. The scale of AI makes strange alliances inevitable. - Costs Will Continue to Skyrocket

With Meta alone spending $10B on Google, plus billions on AWS and Azure, the arms race in AI spending is only beginning.

Conclusion: The Cloud Wars Just Got Real

The six-year, $10 billion Meta–Google deal is more than just a headline—it’s a turning point in the cloud wars.

For Meta, it’s about scaling AI faster than competitors like OpenAI, Anthropic, and yes, Google itself. For Google, it’s about proving that its cloud division is ready to compete at the highest level.

The partnership shows that in the age of AI, even bitter rivals can become essential collaborators. And it underlines a broader truth: the future of cloud computing will be written by the demands of artificial intelligence.

(Article feature image and post images generated with the help of Dall-E.)